does california have an estate tax in 2020

Fortunately there is no California estate tax. In other words under the proposed legislation if an estate in California met the 117 million federal threshold it would not also pay the California estate tax rate just the federal estate tax.

California Retirement Tax Friendliness Smartasset

Then you take the 1158 million number and figure out what the estate tax on that.

. The decedent was a California resident at the time of death. Submit the IT-2 with the completed ET-1 and a copy of IRS estate tax return Form 706. The declaration enables the State Controllers Office to determine the decedents state of residence at date of death.

States That Have Repealed Their Estate Taxes. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Income is distributed to a beneficiary.

Does California Have a State Level Inheritance Tax. When you receive your inheritance there really isnt any income tax. Starting in 2022 the exclusion amount will increase annually based on a.

In the Tax Cuts and Jobs Act of 2017 the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires December 31 2025. However an estate must exceed 1158 million dollars per person in 2020 to be subject to estate tax in the US. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Even though California wont ding you with the death tax there are still estate taxes at the federal level to consider. As originally designed new 2020 California estate taxes would have phased out once an estate hit the current federal level requirement to avoid double taxation. As of January 1 2020 the answer is.

The estate has income from a California source. Assembly Bill 2088 AB 2088 which was introduced in Sacramento in August of 2020 would impose the states first wealth tax. If the property you left behind to your heirs exceeds your lifetime gift and estate tax exemption of 117 million in 2021 or 1206 million for 2022 youd owe a federal estate tax on the portion that exceeds those thresholds.

The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state death tax credit over a four 4 year period beginning January 2002. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. 166250 is also the new limit for small estate affidavits under California probate code section 13100.

State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023. This goes up to 1206 million in 2022.

The 40 estate tax would kick in. The executor may have to file a return if the estate meets any of these. The tax rate on gifts in excess of 11580000 remains at 40.

Its not paid by you the beneficiary. Complete the IT-2 if a decedent had property located in California and was not a California resident. About 4100 estate tax returns were filed for people who died in 2020 of which only about 1900 estates were taxable less than 01 percent of the 28 million people expected to die this year according to the Tax Policy Center.

Seven states have repealed their estate taxes since 2010. The estate tax exemption reduced by certain lifetime gifts also increased to 11580000 in 2020 until after 2025 indexed for inflation and the tax rate on the excess value of an estate also remains at 40. Estate and inheritance taxes are burdensome.

Even though you wont owe estate tax to the state of California there is still the federal estate tax to consider. Net income is over 1000. If you are a beneficiary you will not have to pay tax on your inheritance.

Generally speaking inheritance is not subject to tax in California. Effective January 1 2005 the state. No estate tax or inheritance tax Colorado.

Even though California wont ding you with the death tax there are still estate taxes at the federal level to consider. However the federal government enforces its own. The old amount of assets to be considered a small estate in California was 150000.

The federal estate tax goes into effect for estates valued at 117 million and up in 2021. The District of Columbia moved in the. They disincentivize business investment and can drive high-net-worth individuals out-of-state.

Johnson California Trusts and Estates Quarterly Volume 21 Issue 3 2015 Californias income taxation of trusts has unpleasantly. Under the current tax rules you have to have an estate in excess of 11 million per person before youre going to be subject to estate tax. California Income Taxation of Trusts and Estates May 1 2020 Richard S.

Gross income is over 10000. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. The estate tax is paid by the estate. Because of the large exemption few farms or family businesses pay the tax.

Kinyon Kim Marois Sonja K. The legislature had intended to put on the 2018 ballot and then the 2020 ballot a proposition to reinstate Californias long-abolished estate tax. California is in the midst of a significant overhaul of its tax code and theres one bill in particular that has lots of people talking.

No estate tax or inheritance tax Connecticut. There are a few exceptions such as the Federal estate tax. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws.

The federal estate tax goes into effect for estates valued at 1206 million and up in 2022 for singles. Delaware repealed its tax as of January 1 2018. The trustee may have to file a return if the trust meets.

The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California.

Where S My California State Tax Refund Taxact Blog

12 Irs Non Stimulus Tax Rules You Ll Need This Year Tax Rules Irs Filing Taxes

Large Newcomb 11 Vase Henrietta Bailey 1924 Mar 21 2020 California Historical Design In Ca Historical Design Newcomb Pottery Pottery Art

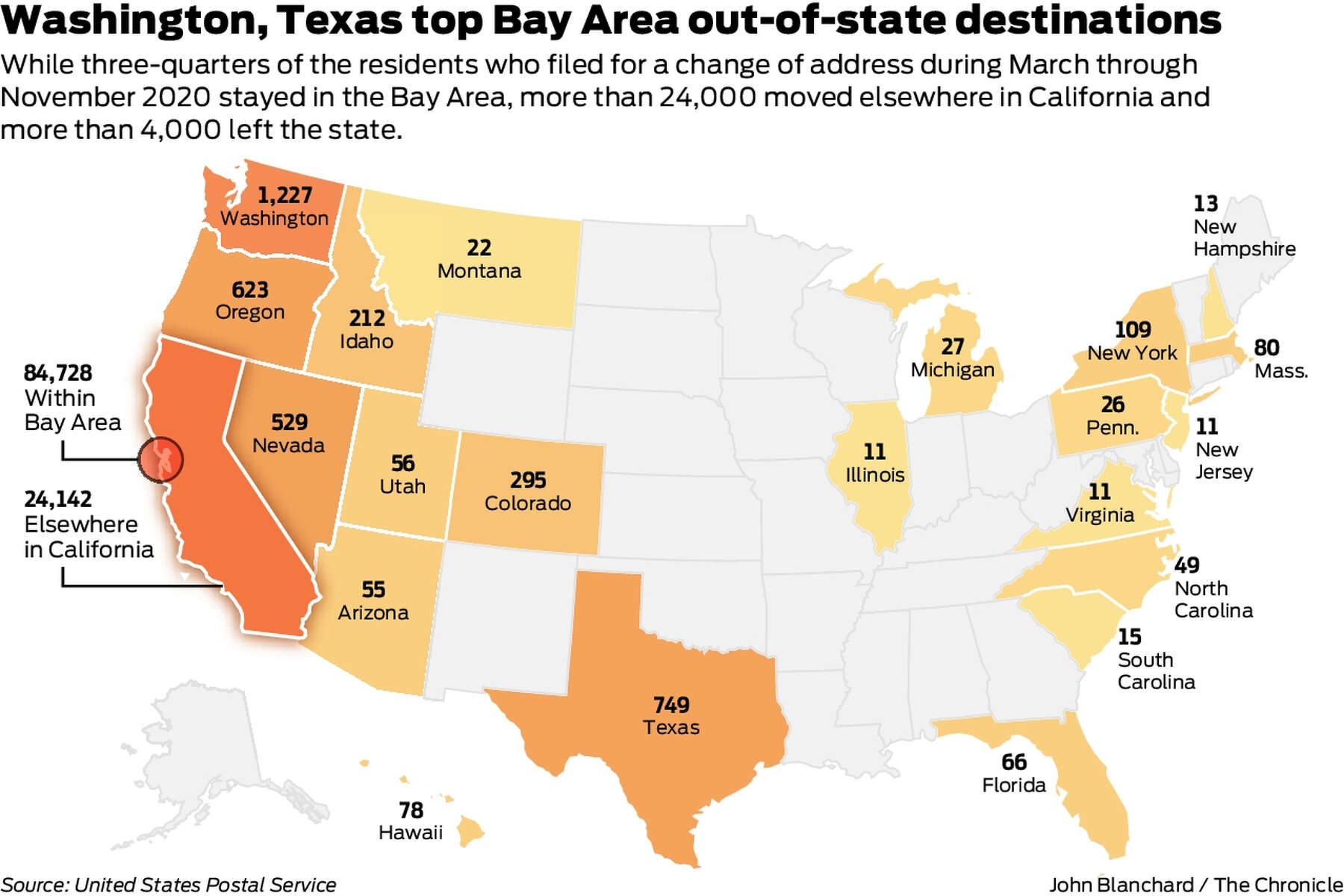

Bay Area S Migration Is Real But Postal Service Data Shows California Exodus Isn T

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Understanding The California Capital Gains Tax

Pin On Retirement Money Pensions Social Security Medicare Estate Planning Senior Travel Aging Wills

Prop 19 And How It Impacts Inherited Property For California Residents Financial Alternatives

How To File Your Taxes After Working Remotely Trading Stocks And Surviving 2020 Tax Irs Taxes Remote Work

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

Moving Avoids California Tax Not So Fast

Inside John Lennon And Yoko Ono S Former Oceanfront Palm Beach Estate Robb Report Mansions Sylvester Stallone Mediterranean Mansion

Fabulous Malibu Rocky Oaks Estate In California Malibu Rocky Oaks Expensive Houses Hacienda Homes

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center